|

| Horace Greeley. |

by Glenn Franco Simmons

Is C.C. Goodwin postulated in his literary masterpiece titled “The Comstock Lode,” more money probably exchanged hands in stock ownership and stock scams, as well as those who supplied all the material needs of the mining companies.

The public interest in vast riches that could be relatively easy to access was palpable in 1872.

First, there was the false claim of a mountain of riches that was reported to contain silver.

“An announcement in the Tucson Weekly Arizonian in April of 1870 catches the mood of the moment: ‘We have found it!” according to Smithsonian.com. “The greatest treasures ever discovered on the continent, and doubtless the greatest treasures ever witnessed by the eyes of man.’

“Located in the Pyramid Mountains of New Mexico, the ‘it’ was a new mine dubbed the Mountains of Silver. Bankers hurried in, miners claimed stakes, investors sought capital in distant cities and surveyors laid out a town nearby. But in the end, the much-touted venture did not yield enough of the stuff for a single belt buckle.”

Then there was the diamond rush in South Africa.

“At about the same time came news of a diamond rush in South Africa, the third major diamond find known to the world after one near the city of Golconda, India, and an 18thcentury site discovered by the Portuguese in Brazil,” according to the Smithsonian.

“Stoked by the tall tales of early 19th-century trapper-guides like Jim Bridger and Kit Carson about diamonds, rubies and other gems that could be scooped right off the ground, avaricious dreamers were soon looking for precious stones in Arizona and New Mexico, where the terrain was said to resemble South Africa’s.”

Adding to the diamond fever, diamonds were found in during the initial California Gold Rush.

“And so the stage was set for the ‘Great Diamond Hoax’, a brilliantly acted scam by two Kentucky grifters that would embroil, among others, some of California’s biggest bankers and businessmen, a former commander of the Union Army, a U.S. representative, leading lawyers on both coasts, and the founder of Tiffany & Co.,” according to the Smithsonian.

In 1872, The San Francisco Chronicle said the hoax was “the most gigantic and barefaced swindle of the age.”

What was the “Great Diamond Hoax” and how did it start?

|

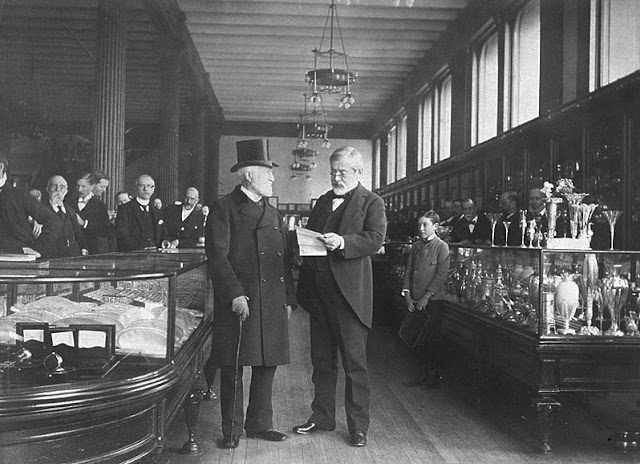

| Charles Lewis Tiffany (left) in his store, ca. 1887. What investors did not know was that Tiffany was not qualified to judge the gems from the bogus gem field. Source: Wikipedia. Public domain. |

“The diamond hoax of 1872 was a swindle in which a pair of prospectors sold a false American diamond deposit to prominent businessmen in San Francisco and New York City,” according to Wikipedia’s “Diamond hoax of 1872” page. “It also triggered a brief diamond prospecting craze in the western USA, in Arizona, New Mexico, Utah, Wyoming, and Colorado.”

The scheme began in 1871 when two Kentucky cousins, Philip Arnold and John Slack, traveled the very long distance to San Francisco, Calif.

Crucial to their skulduggery was successfully convincing potential San Francisco investors that they were privy to a diamond mine. They even produced what was said to be a bag of diamonds and deposited it in the Bank of California — which had significant investments in The Comstock Lode of Nevada in the Virginia Mountain Range.

So how could they produce a bag of diamonds? The answer can be found in an April 2014 issue of The San Francisco Chronicle.

"Arnold was a born con man, Slack his close-mouthed foil," The Chronicle notes. "The 40-year-old Arnold was a small-time miner who was working as a bookkeeper for a drill manufacturer that used diamond-headed bits. He pilfered a bag of uncut diamonds from his work and acquired some garnets, rubies and sapphires, probably by trading with Indians. These were the raw materials of the scam.

"The two crooks could not have chosen a better time to work a hoax. San Francisco was in the grip of a delirium of greed unrivaled since the Gold Rush."

Not only was San Francisco gripped with gold fever, but Virginia City and the rest of The Comstock Lode was in the midst of a silver and gold rush — at the time, the largest known deposit of silver in the world. (Quartz was also mined.)

Wild rumors were spun with a storyteller’s expertise, and in the social currency of the time, it was said that anyone could get rich, and quick, on The Comstock Lode — whether in Six Mile Canyon (current spelling), Virginia City or Gold Hill.

|

| William Ralston. |

Yet investors were still not convinced, so they hired their own mining engineer to examine the diamond field.

The brothers had an answer for that.

“They planted their diamonds on a remote location in northwest Colorado Territory,” according to Wikipedia. “They then led the investors west from St. Louis, Missouri in June 1872. Arriving by train at the town of Rawlins, in the Wyoming Territory, they continued on horseback. But Arnold and Slack wanted to keep the exact location a secret, so they led the group on a confusing four-day journey through the countryside. The group finally reached a huge field with various gems on the ground. Tiffany's evaluated the stones as being worth $150,000.”

The cousins’ trickery worked for now.

“When the engineer made his report, more businessmen expressed interest,” according to Wikipedia. “They included banker {William Chapman} Ralston, Gen. George S. Dodge, Horace Greeley, Asbury Harpending, George McClellan, Baron von Rothschild, and Charles Tiffany of Tiffany and Co.

“The investors convinced the cousins to sell their interest for $660,000 ($13.8 million today) and formed the San Francisco and New York Mining and Commercial Co. They selected New York attorney Samuel Latham Mitchill Barlow as legal representative.”

The investors remind me of those who invested in the alleged fraud of Theranos — the company that promised to miniaturize blood testing but ended up in a shocking Silicon Valley scandal.

These investors, like Theranos, had distinguished and prominent board members who new little about the “gem field” they were going to commit significant sums for investment.

The “gem” investors even called in a powerful U.S. congressman to help them solidify their stake in what they thought were fields of riches.

“Barlow convinced them to add U.S. Congressman Benjamin F. Butler to the legal staff,” Wikipedia said. “Barlow setup a New York corporation known as the Golconda Mining Co. with capital stock of $10,000,000, while Butler was given one thousand shares for amending the General Mining Act of 1872 to include the terms ‘valuable mineral deposits’ in order to allow legal mining claims in the diamond fields. The U.S. Attorney General, George H. Williams issued an opinion on Aug. 31, 1872, specifically stating that the terms ‘valuable mineral deposits’ included diamonds.”

The entire scheme was a comedy of errors worthy of a Shakespearean play.

No comments:

Post a Comment

Spam comments will not make it to publication, so please do not spam this blog. All comments are moderated. Thank you for your consideration.